special tax notice 401k rollover

Special Tax Notice Regarding Your Rollover Options Retirement Systems of Alabama PO Box 302150 Montgomery Alabama 36130-2150. PART THREE contains a special tax notice.

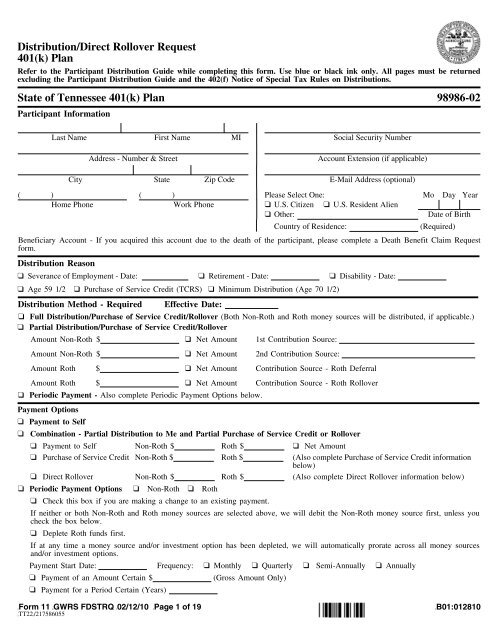

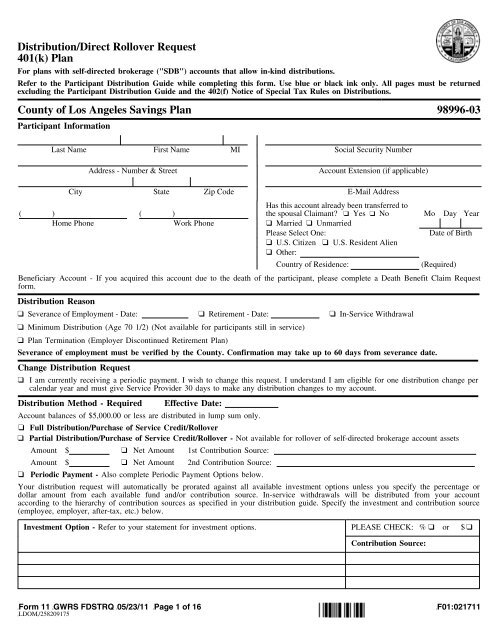

Distribution Direct Rollover Request 401 K Plan State Of Fascore

Special Tax Notice For 401K Rollovers.

. SPECIAL TAX NOTICE For Payments Not from a Designated Roth Account under Governmental 401a Plans. Indiana Public Retirement System One North Capitol Ave Suite 001. We use cookies to improve security personalize the user experience enhance our marketing activities including.

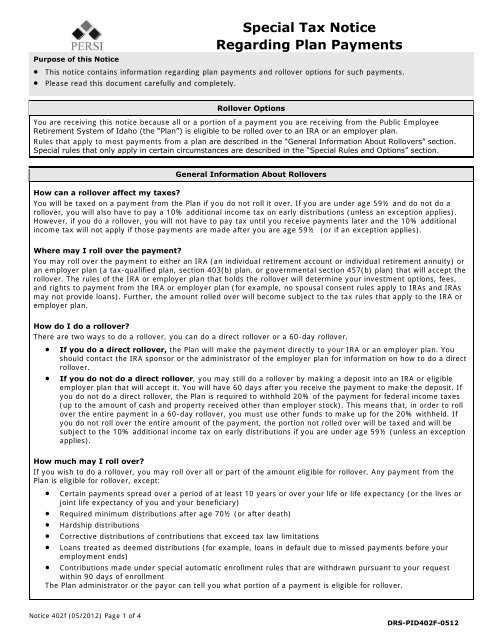

This notice describes the rollover rules. If your eligible rollover distribution is not rolled over it will be taxed in the year that you receive it. This notice is intended to help you decide whether to do a rollover.

Special Tax Notice Regarding Your Rollover. Travis Texas Comprehensive Special Tax Notice Regarding Plan Payments. If you roll over a payment from the Plan to a Roth IRA a special rule applies under which the amount of the payment rolled over reduced by any after-tax amounts will be taxed.

There are important factors to consider when deciding whether to roll over plan assets to an IRA or new. PART ONE of this notice describes the Plan payment options available to you. You may roll over your after-tax contributions to.

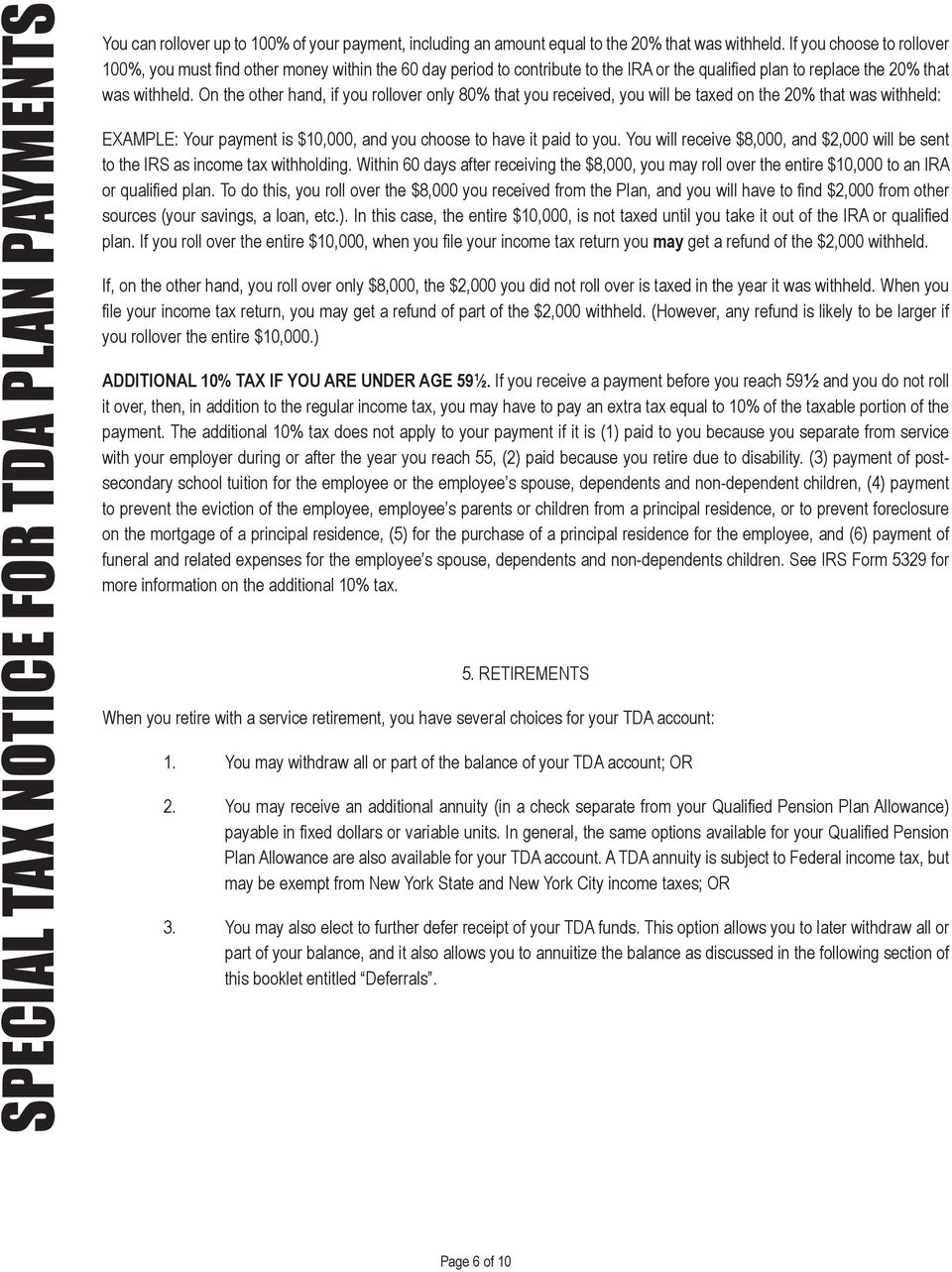

You may roll over the payment to either an IRA an individual retirement account or individual retirement annuity or an employer plan a. If you are under age 59½ and do not do a rollover you will also have to pay a 10 additional income tax on early. You will be taxed on a payment from the Plan if you do not roll it over.

Special Tax Notice Safe Harbor Explanations Eligible Rollover Distributions Updated 102020 Your Rollover Options You are receiving this notice because all or a portion of a payment you. Under limited circumstances you may be able to use special tax rules that could reduce the tax you. PART TWO describes your beneficiaryies payment options.

After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA. Special Tax Notice Regarding Plan Payments Your Rollover Options for Payments Not From A Designated Roth Account You are receiving this notice because all or a portion of a payment. Special Tax Notice Regarding Rollovers The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a review of Internal Revenue Service.

The taxable amount of your payment will be taxed in the current year unless you roll it over. Individual retirement account or individual retirement annuity including a Simple IRA that has been in existence for at least two years or an employer plan a tax-qualified. SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of.

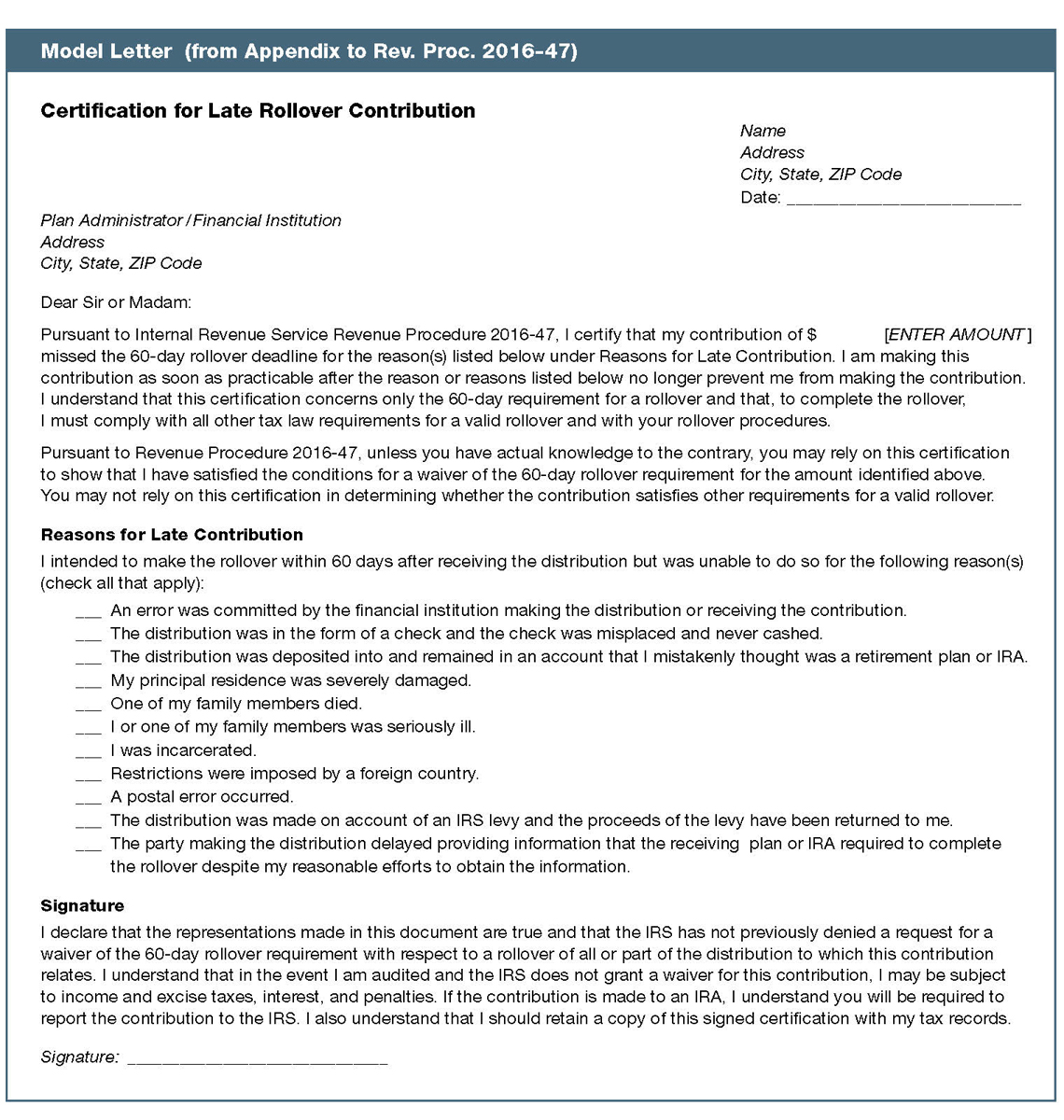

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. The Special Tax Notice also called a Rollover Notice or 402 f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. This notice is intended to help you decide whether to complete such a rollover.

In the Plan the Roth 401k Account the Roth Rollover Account and the Roth Conversion Account are collectively a.

Irs Eases Rules To Fix Ira 60 Day Rollover Mistakes

Fixing 401 K Rollover Mistakes Marotta On Money

Commonly Asked Questions About 401 K Rollovers

/thinkstockphotos-80410988-5bfc348d46e0fb00265d9abf.jpg)

401 K Rollovers The Tax Implications

Do We Have To Provide New Paperwork When A Participant Requests A Second Distribution

The Ins And Outs Of Rollover Iras Vanguard

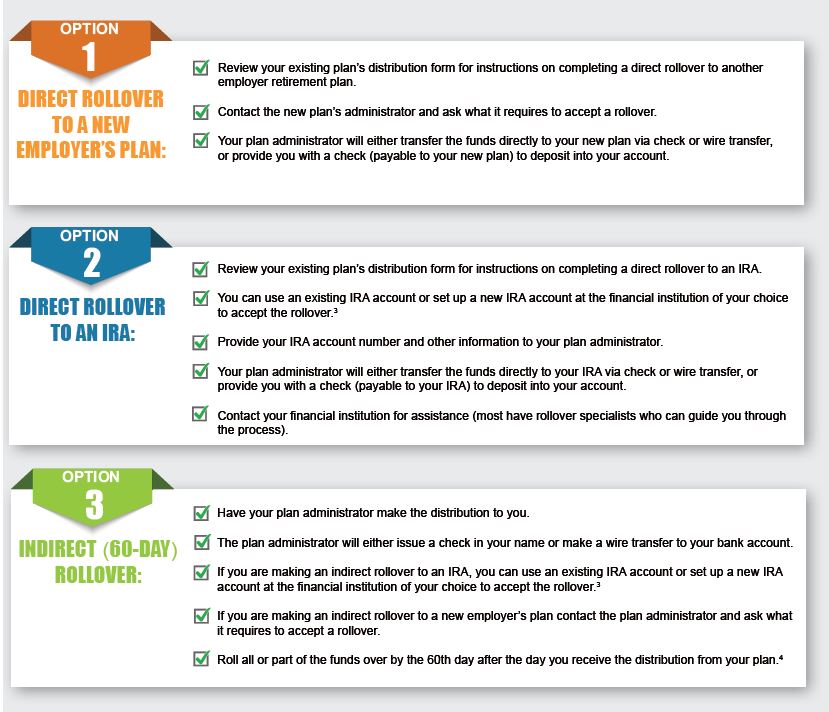

Roll Over Your Employer Retirement Plan Assets First Bank

Irs Eases Rules To Fix Ira 60 Day Rollover Mistakes

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

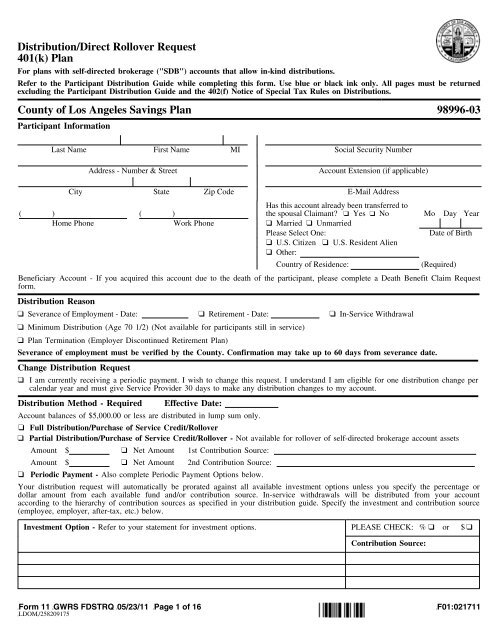

Distribution Direct Rollover Request 401 K Plan County Of Los

Rollover Archives Retirement Learning Center

Special Tax Notice 402f Persi Idaho Gov

Reasonableness Prevails New Irs Procedure Allows Self Certification For Late Rollovers Trucker Huss

Tda Withdrawal Application Pdf Free Download

401k Distribution Request Form Fill Out Printable Pdf Forms Online

:max_bytes(150000):strip_icc():gifv()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)